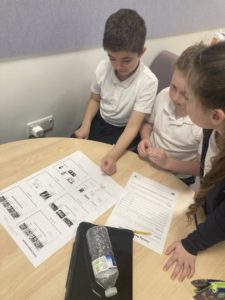

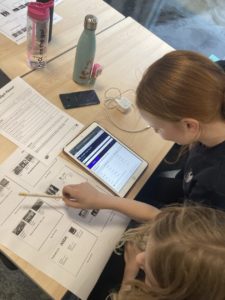

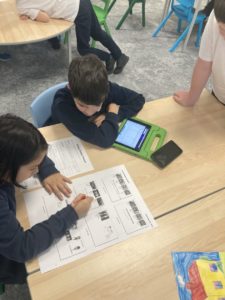

Solving real life maths last week while creating a family budget. Each family had already decided on the role in which they played within their family, which jobs the adults/young teens do and based on the overall family salary, the families worked together to calculate their gross and net income. From that, they decided which house they should live in, calculated the gas and electricity bills, how much a car would cost (some have enough for two) to run i.e. insurance and fuel, food shopping depending on which store they wish to buy from and finally the cost of how much it would be for the kids to go to clubs.

The groups also decided what they’d spend the rest of their monthly income on, how much Christmas might cost and had to factor in an emergency pay out for an unexpected household emergency like the car breaking down, a burst pipe, family visiting for a weekend or a broken washing machine.

Each family completed budget sheets and tracked a balance as money left their account. A variation of mental strategies were used as well as checking answers using technology.😜