It is essential for firms to be in control of their finances as many business decisions depend on how much money the firm has! There are several accounting documents which enables them to do this accurately one of which is a Cash Budget.

What is a Cash Budget

A budget is a plan of how much money you have and how you will spend it.

A Cash Budget shows the money that comes in and goes out of the business during the year.

Preparing a Cash Budget Should Mean That:

- the business finances are better controlled and monitored

- the business can see where problems in its cash flow will arise

- decisions can be taken about purchasing e.g. the best time to make a big outlay of cash for machinery etc.

As the Cash Budget is prepared ahead of time, sometimes, due to external and unexpected factors, the budget does not go completely to plan.

What Does A Cash Budget Show?

- shows how much cash the organisation will have available, generally on a month to month basis

- shows what money is expected to come in during that time;

- shows what money is expected to get spent during that time;

- alerts the business to any cash flow problems;

- is used to help make decisions;

- can be used to forecast whether a loan or overdraft may be necessary.

Cash Budget Example

- A Cash Budget begins with the opening balance. This is the amount expected to be available to the firm at the start of the month.

- The next step is to anticipate the receipts for the month (money coming into the business) and add to the opening balance.

- Then payments forecast (money going out of the business – bills) to be made by the firm are taken away. This gives the closing balance.

- Closing balance – This is the amount of money left at the end of the month.

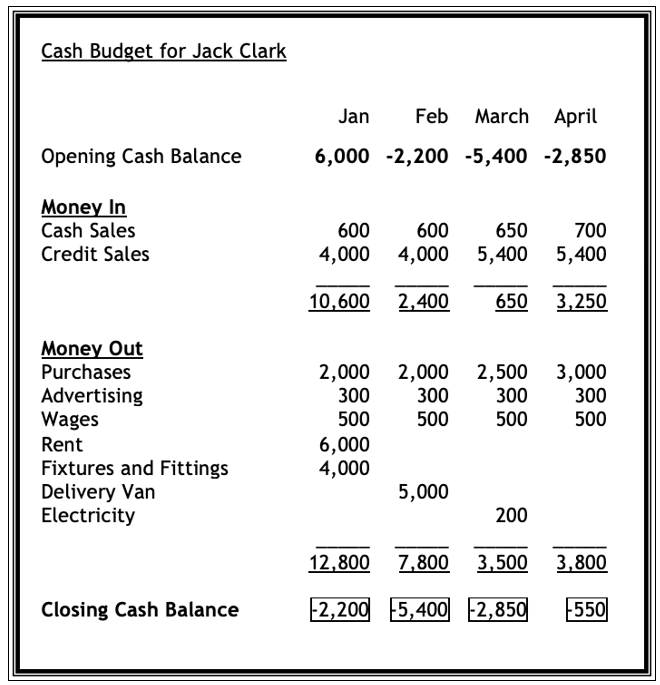

The following example explains and illustrates a Cash Budget. The information is for Jack Clark, a sole trader business and applies to the first quarter of the year.

- The opening balance is the amount of money in the bank or in cash in the business at the start of the month.

- This is added to the total cash in. This is any money received into the business e.g. from selling goods. This gives the total cash available for that month.

- Then, cash out (any amounts paid out of the business) are taken away. This gives the closing balance. It is the amount of money left in the business at the end of the months trading.

- The closing balance at the end of one month is the opening balance for the next month.

What Do We Use a Cash Budget For?

Jack can now use the Cash Budget to plan ahead and help to make decisions and not run the risk of not being able to pay his bills. For example, suppose Jack has decided that in February that he wants to buy a new delivery van for the business.

The total cost will be £5000. By planning ahead and looking at his cash, he realised that he cannot afford it just now as he does not have enough cash to buy it.

To ensure his business does not get into cash flow problems, he could consider:

- getting a loan for the van – by applying for a loan Jack could get the van straight away and pay it off month by month. However, interest would have to be paid to the bank in addition to the repayments for the loan.

- buying the van on credit – again Jack could get the computer straight away but usually he would have to pay interest along with the monthly repayments.

The Cash Budget is therefore be used in decision making in businesses. It shows whether there is enough money for the business to do what it plans. It can also show whether a business needs to find cash from somewhere else.

It can help business answer questions like:

- Do I need to arrange an overdraft/loan?

- Do I have enough money to buy a new piece of equipment?

Cash Flow Problems

Cash flow problems can arise even if the firm is successful in selling a lot of its goods. If goods are being sold on credit, customers do not pay for their goods straight away. This can lead to cash flow problems as the company is having to pay for their stock and overheads like heat, light, petrol, rent and wages before their customers are paying for the goods.

It is therefore vital that cash flow is well controlled to make sure business is successful. As a result, the business should look into the following and make decisions to minimise the risk:

- Timing of flows of cash into and out of a firm is crucial. It is as important as the total amount of cash generated.

- Companies don’t go bankrupt because they lose money, they go bankrupt because they run out of money.

- Companies that make sure that they always have enough cash available for their needs are more likely to be successful.

Methods of Improving Cash Flow

There are a lot of decisions a firm can make to improve their cash flow. Doing this can help them to avoid cash flow problems. The kinds of things, which help to improve cash flow, include:

- Taking out loans – from a bank or small organisations can get a loan from friends or partners. By doing this, the organisation will get an inflow of cash but repayments (including interest) will have to be made regularly.

- Raising extra capital – re-investing profits, issuing shares, owner investing more funds. By doing this, the firm will get an inflow of cash.

- Tight credit control – this means that the firm should ensure that it collects the money owing from debtors (people who owe the firm money) as quickly as possible. This will improve the inflow of money but may cause bad feelings with customers who may leave and go to other suppliers.

- Delaying payment – taking longer to pay bills or invoices for purchases of stock. By doing this, the organisation will reduce the outflow of cash until cash has been received from customers. However, this may upset some creditors who wish to get their money as quickly as possible.

- Spreading purchase costs – hire purchase or leasing. This will mean that the outflow of cash will not be in one month but will be spread over a number of months.

- Tight stock control – ensure capital is not tied up in too much stock. This will ensure that the outflow of cash is kept to a reasonable level.